Introduction

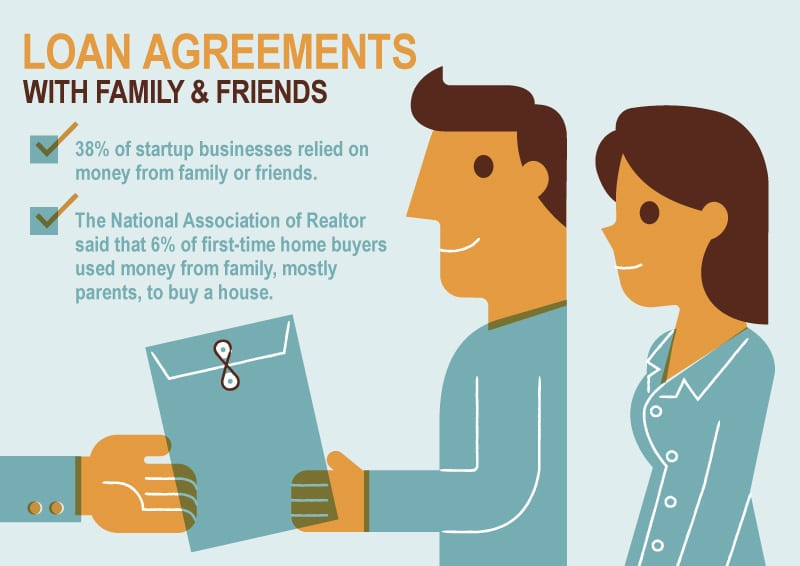

It would help if you started with your own family for a loan. However, you may have heard the standard warning: Never lend money to a family member, even though loans from family members can be a great deal, especially for the borrower. There may be tax ramifications and financial risks associated with these loans. Consider these guidelines before extending credit to loved ones.

What Is A Family Loan?

How much can my family borrow loans? A loan between relatives is called a family loan or an intra-family loan. Personal loans from banks or the P2P marketplace, which match investors with borrowers online, tend to be more formal than family loans. Although family dynamics may justify an informal loan, it is still a contract and can have tax implications for both parties: The interest earned by a lender is subject to taxation. Things get more complicated if the lender doesn't charge interest. Taxes on "imputed interest charges" are real, and the lender has to pay them to the IRS. Interest that is "imputed" by the IRS is the amount of interest the agency believes the lender should have charged. Peer-to-peer loan administrators may be compensated to handle the paperwork and collect payments on behalf of borrowers who find tracking interest, fees, and tax implications too much of a hassle.

The Advantages Of A Family Loan

Loan rates can be significantly reduced from what a conventional lender would charge.

Fair Loan Conditions That Work For Everyone

Shorter or longer loan terms, or payments made entirely of interest at the outset, are all options that the lender and borrower can negotiate.

Credit History Flaws Are Not A Problem

Although a less-than-perfect credit history might deter some lenders, there are no such barriers when lending between members of the same family. Family loans have very different requirements for approval compared to conventional loans. Family members typically do not look at your credit report to determine whether or not to lend to you. Despite your credit history, a family member is more likely to be understanding. It's common for family members to extend loans to one another at interest rates much lower than what a traditional financial institution would charge.

Conspiracy at the Airport

Your relative may be willing to take on more risk to secure a loan if they urgently need funds despite their low credit score. It's less risky for them to borrow from you if you have a solid plan for getting your money back.

Forbearance

If the lender knows the borrower personally, they may be more understanding if the borrower experiences temporary financial hardship and requests a delay in making payments or a reduced interest rate on a family loan.

The Proper Way To Borrow From Loved Ones

A loan from a loved one or a friend can be an excellent way to get your business off the ground. You are the only one who can truly understand you. Further, they are typically able to provide more favorable loan terms. A few of these alternatives to traditional lenders include not needing collateral, no application fee, lower interest rates (or even zero! ), and the option to skip a payment or two. There are, however, some rules you should follow to ensure that your friends don't end up in court or are disinherited.

Options Besides Taking Out A Loan From A Family

When deciding whether or not to take out a family loan, it's essential to consider all your available financing options. Personal loans are available from numerous financial institutions, including banks, credit unions, and online loan providers. The money can be repaid in monthly installments for two to seven years. Personal loans can be used for anything from debt consolidation to home renovations. Loan rates are between 6% and 36%, with the best terms available to borrowers with credit scores of 690 or higher. You can get a loan even if you have bad credit through some online lenders and credit unions. Though the interest rates on bad credit loans are high, they are still much more manageable than those on payday advances.

Conclusion

You should carefully plan out how much money you want to borrow and how you'll be able to pay it back before approaching a family member about a loan. Think about who you might ask; you wouldn't want to burden a family member who is struggling financially by asking them for a loan. We know there's no way to tell if helping those we care about with a loan won't lead to disappointment and arguments, but we will still try. The best thing you can do if you agree to lend money to your family is to have a plan. Ensure your partner knows the loan and its terms and set reasonable expectations.