Introduction

Most people do not look forward to filing their annual tax returns. Many people get nervous just thinking about interacting with the IRS. However, it's all a matter of weighing the pros and cons before deciding whether or not to hire an accountant to file your tax returns. If you would get a much larger refund if you filed your taxes yourself, but an accountant can help you find enough deductions to make it worthwhile, you should hire one.

When Do You Require the Services of a Professional?

You Don't Have The Time And Patience To Deal With It.

You may consider hiring a tax professional if you don't want to spend much time on this task and would rather use that time for something else. Avoiding a filing mistake by taking your time is probably the wiser option.

You Have A Complicated Tax Situation.

Almost all monetary dealings have some tax implication, and the more dealings you engage in, the more factors you must consider. Business owners, freelancers, and the self-employed may need a tax expert to smooth out their unusual tax situations, such as the deductibility of home offices, business meals and travel, and vehicles.

You're Planning To Itemise Your Deductions.

Because the Tax Cuts and Jobs Act raised the standard deduction, fewer taxpayers opt to itemize their deductions. However, if you have significant medical expenses, a hefty mortgage, or make substantial charitable contributions (among other criteria), itemizing your deductions could save you more money than the standard deduction. However, if this is your first time itemizing, you may find it difficult to do it independently.

You've Had A Major Life Change In The Last Year.

How about marriage? Get a mortgage? Get pregnant? All of these affect your tax return, and you might want some guidance the first time you have to include them.

You Own Your Own Business

When you're self-employed or operate a business, hiring an accountant can help you file your taxes accurately and avoid making any mistakes that could cost you money. To avoid being hit with a hefty tax bill at tax time, your accountant can advise you on how much you should pay in quarterly estimated tax payments in the future.

Major Life Changes

Your tax situation will evolve dramatically as you age and your finances get more intricate. It will change how you file, for instance, if you purchase your first home during the tax year. An accountant can help you maximize your tax deductions and advise how to modify your withholding to reflect the changes.

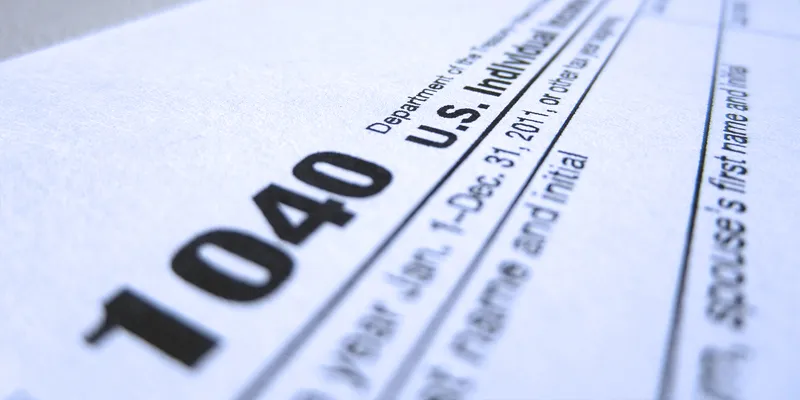

How Much Does an Accountant Cost?

According to the National Society of Accountants' national Income and Fees study for 2020–2021, the average cost of preparing a Form 1040 (individual tax return) with a standard deduction was $220, and the cost of preparing a Form 1040 with itemized deductions was $323. However, the total sum may change based on the specifics of your case. The earned income tax credit, business income, rental income, and investment income all require separate tax returns, which may incur additional costs. CPAs use multiple fee schedules. While others have a set fee per form submitted, others charge by the hour. Preparers who base their fees on your refund amount or who guarantee you a sizable return are to be avoided, according to the Internal Revenue Service.

Benefits of Using an Accountant

Hiring an accountant to handle your tax preparations has obvious benefits, such as having someone familiar with your financial situation and representing you before the IRS in the event of an audit. Your tax refund will arrive quickly if your accountant can e-file your taxes and you have direct deposit set up with your bank.

If you have fallen behind on your tax payments in the past, hiring an accountant to assist you in filing is also a good idea. Your accountant can help you negotiate with the Internal Revenue Service (IRS) to avoid having your wages garnished or your credit rating ruined. If you've made any significant purchases or started any business in the past year, financially speaking, you should also consult with an accountant. Your tax situation may also change significantly after a marriage or divorce, making it more important than ever to consult a trained professional.

Conclusion

Most taxpayers now file their returns using one of the many tax preparation programs or apps that can be found and used online. This method makes filing your tax returns immediately from your smartphone or another mobile device quick and easy. In addition, the IRS Free File program provides some taxpayers with access to tax preparation software at no cost. You would qualify for the program if your taxable income in 2021 were less than $73,000.